How To Find The Best 1031 NNN Properties For Sale

NNN 1031 Investments - Tractor Supply Company TSC Deals

Here is a quick video from the 1031 Exchange Passive Income & Investment Series about NNN Tractor Supply Investments.

Investing in TSC NNN Deals - Thomas takes a look at Tractor Supply Triple Net property investments for 1031 Exchanges.

FREE 1031 NNN CONSULTATION

Speak with our founder: Thomas Morgan, CCIM Click to ClaimThe Pros and Cons of Triple Net Properties

In some ways, triple net properties are as much fixed-income investments as they are real estate vehicles.

Offering little to no management responsibility and long-term fixed incomes with the potential for gradual increases, they act like bonds.

However, underlying their financial structures, NNN properties are still real estate and carry the same eventual risks and challenges.

Here are some of the pros and cons of triple net lease properties:

Pro: Stable Income

Con: Limited Upside

Triple net leases are usually structured with a flat rent or with fixed increases. When you buy a $2,000,000 property at a 7.5 percent cap, you know that you can count on $150,000 per year for the life of the lease. Many triple-net properties also have rent increases of 1 to 2 percent per year built-in. They provide some growth, but don't necessarily keep up with inflation. However, this is no different from buying a corporate, Treasury or municipal bond with a fixed rate of return.

Pro: Long-Term 100% Occupancy

Con: Risk of 100% Vacancy

Most triple net properties come on the market with a lease of at least 10 years, with some having initial terms as long as 25 years. This gives you a long time during which you don't have to worry about partial or full vacancy. The drawback is that when the lease does expire, it's an all-or-nothing proposition. The same occurs in the event of a tenant default, although careful due diligence before purchase can reduce the risk of this occurring.

Pro: Attractive Cap Rates

Con: High Price Relative to Underlying Value

Single tenant properties typically trade at attractive cap rates that are hundreds of basis points above comparable non-real estate investments. They're also frequently priced lower than more traditional investment real estate alternatives on a cap rate basis. A large portion of their value comes from their income stream, though, meaning that they could lose value when vacant or as their remaining lease term decreases.

Pro: No Management

Con: CapEx at Rollover

True triple net properties are structured so that the owner has no responsibilities whatsoever during the lease period, while others transfer some capital expenditures to the owner. In either case, the ownership experience is very different from traditional real estate. However, when the lease rolls over, owners have to get involved in the re-leasing process and in any necessary capital expenditures to prepare for a new tenant.

What do you see as the benefits and risk?

Or Contact Thomas Morgan, CCIM Triple Net NNN Broker at 1-866-539-1777

How to Select the Best Triple Net Broker

Given that a net-leased investment typically costs millions of dollars, finding a good triple net broker is particularly important. Working with a good triple net broker will give you better access to inventory, better financing, and a better investment result.

Here are a few things to look for in your quest for a top-line triple net broker.

Fundamental Knowledge

Many of the triple net broker firms in the market lack a solid understanding of the fundamentals of an NNN investment. Look for a triple net broker who knows the difference between a double net, a triple net, and a "true" triple net lease. Your triple net broker should also understand the credit rating system, as this will help them, and you, measure the risk of a given tenant.

Access to Inventory

A strong NNN broker will have a large and diverse inventory consisting of a mixture of their own listings as well as properties offered by other triple net broker companies and off-market deals. This will let you choose from a number of different properties to find the right mix of lease terms, lease length, and tenant quality.

Access to Financing

A good triple net broker knows that the lender can make or break the deal. As such, you should look for a triple net broker who either has an in-house commercial mortgage broker or a strong relationship with an outside broker. Your triple net broker should also understand the many different financing options available, including bank financing, life insurance financing, conduit debt and the "CTL" credit tenant lease programs that provide long-term fixed rate debt for NNN assets.

Client-Focused Business

Your triple net broker should take some time to get to know you and your goals. They should then show you appropriate property. If, for instance, you express a desire to have long-term stable income and your triple net broker shows you properties with five or fewer years remaining on the lease, you may want to select someone else. Watch for a NNN broker who does not attempt to saddle you with more debt than you want. Although some debt carries a number of benefits, it also carries risk, and a good triple net broker will help you strike the right balance.

Experience

Your triple net broker should have a few deals under his or her belt. Although some of the most active triple net broker teams in the company focus on seller representation, there are a large number of good buyer representatives who have amassed a large resume of experience. Work with a triple net broker like that, and if they have a well-respected designation, like CCIM, that is an additional plus.

Opportunity Zone? - What is the difference between a 1031 Exchange and a Opportunity Zone Investment?

What is all the buzz about Opportunity Zones?

If you are a real estate investor or concerned about how much tax you pay then you have heard of Opportunity Zones.

Like a 1031 Exchange, the OZ legislation is meant to spur economic growth by providing capital gains tax relief.

I was fortunate to be a guest this week on Jimmy Atkinson's popular Opportunity Zones Podcast.

What is Triple Net NNN? - Triple net lease definition

Is the Lease really NNN? - 1031 Exchange & Passive Income Investment Series

Today we look at if the Lease is really triple net? Is it absolute net, triple net or double net?

Get the Whole Podcast on Itunes here.

In NNN investing, the lease is one of the most important things. The point of investing in NNN properties is to have a hands off investment.

When buying NNN properties make sure to read the lease to see if it is really true NNN or not.

Many triple net brokers and NNN sellers will advertise the lease as "net leased" or "ease of management" or "minimal landlord responsibilities" . Often times the lease will have more landlord responsibilities that advertised. Thomas Morgan, CCIM of 1031navigator.com talks about absolute net leases, NNN leases, and NN leases.

Beware of opening escrow without having read the lease to see if it is triple net or not. This will save you time and money on your 1031 exchange NNN property purchase.

Is the Lease really a NNN Lease? - Triple Net Properties Q&A

Today we look at if the Lease is really triple net? Is it absolute net, triple net or double net?

In NNN investing, the lease is one of the most important things. The point of investing in NNN properties is to have a "hands off" investment.

When buying NNN properties make sure to read the lease to see if it is really true NNN or not.

Many triple net brokers and NNN sellers will advertise the lease as "net leased" or "ease of management" or "minimal landlord responsibilities" . Often times the lease will have more landlord responsibilities that advertised.

In this Video and Audio Q&A Thomas Morgan, CCIM of 1031navigator.com talks about absolute net leases, NNN leases, and NN leases.

Beware of opening escrow without having read the lease to see if it is triple net or not. This will save you time and money on your 1031 exchange NNN property purchase.

Video

Audio Version

Subscribe in iTunes or Stitcher

1031 Navigator helps investors nationwide find the best 1031 Exchange replacement properties in the shortest amount of time.

Our focused expertise, experience and daily triple net market presence enables clients to complete their 1031 Exchanges with peace of mind and certainty. 1031 Navigator has been involved with over half a billion dollars of 1031 Exchange NNN Properties in over 30 states.

1031 Navigator is a service of Andrus & Morgan Co., a national commercial and investment real estate brokerage specializing in passive income investments.

For a free, no-obligation 1031 Exchange NNN Property Strategy session for your 1031 Exchange visit:

http://www.1031navigator.com

5 things to look out for when buying a Dollar General 1031 Exchange

Triple Net Properties News

Why are drug dealers the best tenants?

These Passive Investments Pay You to Golf

Every wish you were a golf pro or could get paid to golf?

Get paid to do what you love.

At some point we all wish we could get paid to do what we love. (see: doing what you love while getting paid) Does it matter where the money comes from? Do you have to be Tiger Woods to get paid while you play golf? No. You can get paid by other sources while playing golf.

Passive investments allow you to be "passive" and collect money from the investments. A business is active and Tiger Woods is a business. He has to work to make money. He has to show up. He has to perform. Then he collects.

Tiger does have many passive parts to his business like his endorsements which allow him to collect money while doing other things besides playing golf. Regardless of his golf performance or his tabloid success Tiger Woods will be able to collect passive income for life just because he is Tiger Woods.

Unfortunately, you are not Tiger Woods.

However, you can still get paid to play golf.

Consider these passive real estate investments.

These triple net properties require little or no management and will pay you while you play golf, they will pay you while you travel, even pay you while you eat and sleep. The leases are triple net so the tenant takes care of pretty much everything and you collect the rent check.... while doing what you love.

These triple net properties pay you to do what you love.

Contact TMO for more details on passive real estate investments like these triple net properties:

Lowe's Net Leased Property $6,665,000 Excellent location across from a Walmart anchored retail corridor,Average Household income of $83,141 in 5mile radius,Absolute net lease, Attractive assumable financing requiring only $1.4M.

FedEx Net Leased Property $6,000,000 Cap rate 7.23% Fifteen (15) Year Lease, FedEx Corporate Guarantee (BBB), Expandable Facility

hhgregg Net Leased Property $6,143,000 8.50 % Situated on Major Retail Corridor with Over 78,000 Vehicles Daily, Irreplaceable Retail Location with Outstanding Residual Value, Growing, Publicly Traded Regional Retailer with 174 Store Network

Orchard Supply Hardware Net Leased Property $11,110,000 Cap Rate 7.5% Rent increase by 11% in 2014, Primary lease, The Kroger Co - S&P rated BBB, Assumable $7.5 million loan

Starbucks Plaza Net Leased Property $4,604,000 8.20% Cap Rate 100% Occupied Strip Center with historically low vacancy. Mix of national, regional and local tenants, heavily Trafficked, Signalized Intersection Location.

National Tire and Battery Net Leased Property $ 3,668,000 Cap Rate: 7.50% Brand New 20-Year Lease with National Tire and Battery.Cpi increases every Five year with max of 12 persent. New sweven year lease with American mattress. average household income in 1 mile radius - $129,000. over 11800 resident in 5 miles.

Contact TMO for more details on any of the above passive investments and net leased NNN property deals via email or phone at 1.866.539.1777

Deals are a sampling of available NNN inventory from around the US and are for reference only.

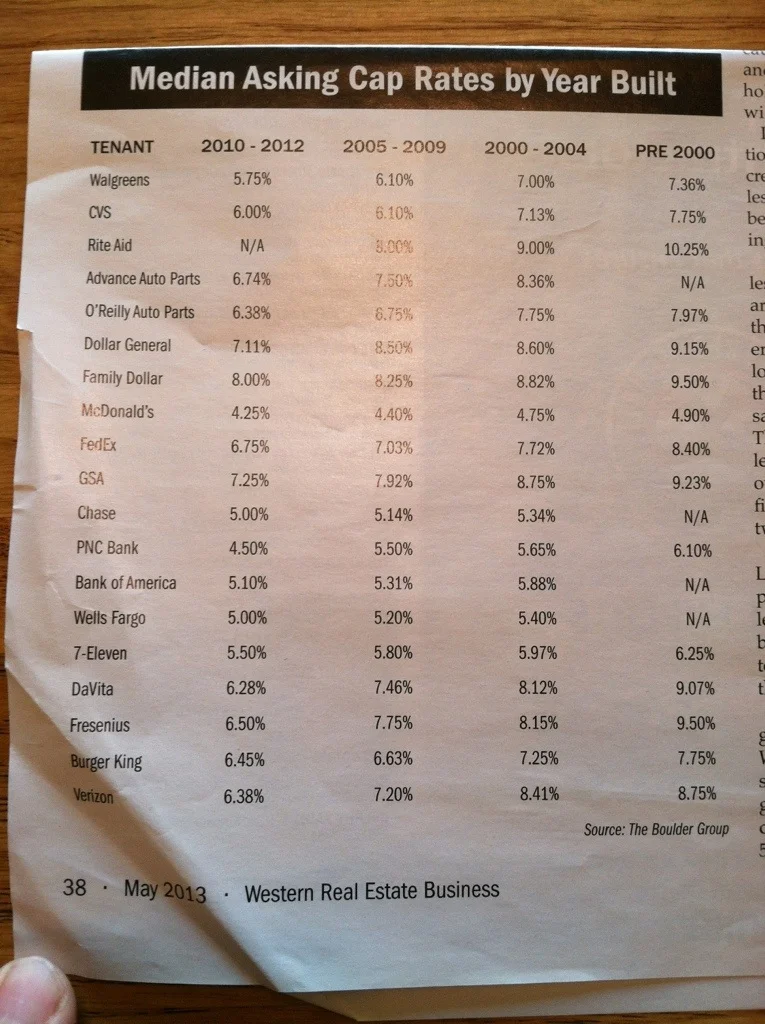

Current NNN Cap Rates

Here is a great chart of current asking cap rates for single tenant NNN deals. It is sorted by NNN tenant and NNN year built. Originally published in Western Real Estate Business May 2013. Data by Boulder Group.

"Ignore the Recession" - More reasons to buy a Net Leased TSC

TSC is one of my favorite NNN tenants. Nice buildings, great locations, solid financials, long leases, low management for owners; the list goes on and on. ABC News Nightline did a segment this week of why TSC is a "Recession Proof Retailer". TSC's internal strategy has been to "ignore the recession". It appears to have worked.

Net Lease Properties a Hot Commodity Due to Low Yields on Alternative Investments

Today a 10-year government bond would yield a return of approximately 1.5 percent, while a net lease building offers returns from 5 percent to 8.5 percent or greater. There is also little risk associated with class-A net lease properties—as long as the location is good and the building is well-maintained there will always be tenants willing to sign leases even if the existing occupant leaves. This inspires greater confidence in conservative investors than the recently volatile stock market.